The first post I ever wrote under the personal finance umbrella was on the basics of credit cards - not because it was the most important part, or because it was the first thing to do in personal finance, but because it was the “sexiest” topic that was the easiest to talk about. The flowchart helps get the big picture [1]; balancing a budget to track inflows and outflows is probably the most important… but no one really gets excited about either of those things. On top of that, it’s more fun to write about credit cards than it is to write about other topics, mainly because the basics of money in = money out don’t change. Even if there’s other stuff going on in the world beyond coronavirus and the 2020 election, most people would rather write about something exciting. I carry the same biases.

Anyways, a friend asked me the other day about how you’d get started with credit cards, a topic I purposely strayed away from last time due to length. Doing the topic justice would have distracted from the flow of everything (and required more effort than I was ready to give at the time). Let’s dive in.

why would you want to build your credit score?

So I’m really, really into cars. I’m a huge fan of Tesla, and one day I’d like to get my own Model S or Model 3. So like any other Friday, I took a look around Carvana and found this sweet ride:

$50,000 is a not-insignificant amount of money, however, so at the present, I’d need to finance the car if I wanted it (to be clear, I don’t endorse 22-year-olds buying $50k cars, nor do I endorse financing a car either). Here are screenshots of how much I’d have to pay each month, with the same amount of money down ($34,100) on a 36 month loan, for four different credit scores: 580, 630, 680, and 780:

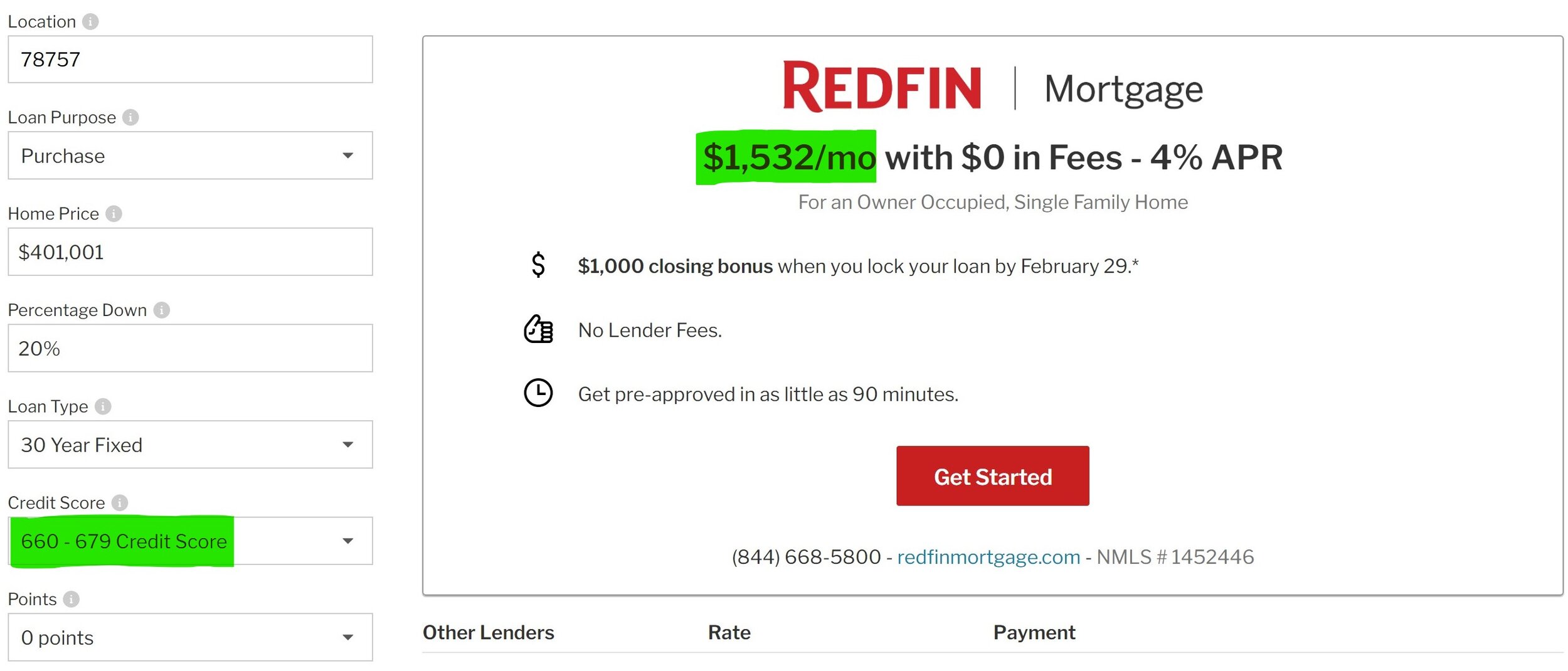

Here are the highlights: the difference in APRs is nearly 8% - translation, I’d be paying a lot more interest: the difference between the highest and lowest credit score payments is $828 per year, or $2484 over the course of the loan. When it comes time to buy a house, which I’ll almost certainly need to take out a loan for, the money on the line is going to be a lot more. I went on Redfin on found a ~$400,000 home for sale in Austin, TX, and looked up mortgage payment for 5 different credit score ranges, from 660-679 to above 740:

This time the difference is smaller between scores: only about 80 points or so. But that difference translates to a 0.75% APR difference, which works out to $1,632/year (an entire payment and then some), which in turn is $48,960 over the course of the 30 year loan (I could buy a Tesla for that!).

Building your credit score now helps you get more favorable interest rates in the future. It also helps get you access to better (read: more rewarding) credit cards, and credit scores also play into housing applications.

I should be clear: credit scores aren’t the only thing that matters in the big picture of personal finance - but it is a factor, and a good one is nice to have.

credit isn’t pay to play

A misconception that I’ve heard a few times is this idea that you need to take out loans and pay interest to build credit. In no way should you need to pay money to build credit. You don’t need to take out student loans for the sole purpose of building credit - if you need a loan, take out the loan, but don’t include “building credit” in the pros list. As I mentioned in my first post, you also don’t need to carry a balance to build credit - carrying a balance isn’t responsible use of a credit card. This post on r/personalfinance is gold.

you shouldn’t get a credit card if…

If you don’t know about credit cards and how they work, you should start off by figuring that out. While I’m more than happy to plug my own stuff (I think it’s great, if I say so myself), r/personalfinance is a gold mine, and this wiki is particularly helpful.

The caveats are simple: don’t get a credit card if you don’t have money to pay for your expenses (and you should probably try and figure that one out, fast), and don’t get a credit card if you know you can’t handle it. In other words, unless your parents are financially carrying you through college, if you don’t have an income, if you don’t have a budget, if you have poor spending habits… don’t get a credit card. You should also have some form of emergency fund before you start off.

The only way to properly use a credit card is to pay it off, in full, each month.

getting started

Okay, you’re in a solid-enough financial place to get a credit card. Congratulations! How you get started if actually pretty straightforward: find a card, apply for it, get approved, and use it responsibly. The “get approved” step is the hard part, so I’ll first discuss how to tackle that.

authorized users and the piggybacking pathway

If you’re lucky and have parents that have their financial houes in order, then you should consider becoming an authorized user (AU) on their credit card. Basically, it’s still their credit account, but you’ll get your own card. To use an analogy that’s perhaps a bit too millennial/Gen Z, you’re all sharing the same Netflix account, but everyone has their own profile. If you make a purchase, they’re still on the hook for it, not you - but how you and your parents work out paying for things and splitting rewards is for you to figure out.

The advantage of becoming an AU is that (1) you’ll be able to use whatever credit cards your parents have, which perhaps you wouldn’t be able to get on your own just yet, and (2) as long as your parents use their credit cards responsibly, their good history and on-time payments will make their way into your good history and on-time payments [2].

The downside to this route, however, is that you’re tied to your parents’ habits. If they miss a payment, it’ll look like you missed a payment also. Only go down this route if you know that your parents are financially responsible. Some people might have reservations about being more dependent on their parents - while this isn’t something I can personally relate to, don’t do anything that makes you feel uncomfortable. Finally, there may be a fee associated with adding an AU (at least on the higher end cards) - whether your rewards make up for that is something you’ll need to calculate.

This option only gives a minor benefit, but it’s worth taking to help get started.

the diy route

Regardless of whether you go down the AU path or not, it’s worth exploring options on your own. The general beachheads are: (1) the bank that you already use, (2) starter/secured cards, and if you’re a student, (3) student cards.

the bank you already use

My first credit card was a fairly basic one from Charles Schwab, where I banked at the time. Even though I had no credit beforehand, Schwab approved me basically on-the-spot (the rewards were also automatically direct-desposited into my account, which was pretty nice). In general, you might have some luck with the bank that you already use. Just make sure that you aren’t paying any fees for it, and see what luck you get.

student credit cards

Student credit cards are available to (you guessed it) students, and while they won’t be top-tier in terms of rewards, they’re a good starting point. I’d look into what Discover offers, and Citi’s student card is a bit of a wildcard with their rewards that could be quite beneficial if you have a bunch of small purchases (it rounds up each purchase to the next 10 points).

secured credit cards

I have no personal experience with secured credit cards, but from my understanding the basic idea behind a secured credit card is that you put down some amount of money, which then becomes your credit limit. Secured cards, generally speaking, aren’t too great since they don’t have great rewards and some have fees associated with them (which is stupid, given that you’re literally putting down your own money). Reddit tends to recommend the Discover It Secured, which actually seems pretty decent - but I’d say that the category in general is a last resort.

additional resources

The r/personalfinance Credit Building wiki is fantastic.

Appendix: How Credit Scores are Calculated

If you’re interested, there are 5 factors that play into your credit score. Technically speaking, there’s no one credit score out there - virtually every single lender has their own version of a scoring system that weights certain components differently, but the components are usually the same, and some are routinely more heavily weighted.

On-Time Payments: This is pretty straightfoward: what percentage of your payments are on time? Just one late payment can harm this, so your goal should be sure to keep this at 100%. This usually the most important factor in your score.

Credit Utilization: What percent of your credit limit are you using? This is calculated in the aggregate (i.e. the total amount of credit you’re using across all cards, divided by the total amount of credit you have access to, across all cards). Lower is better - you don’t get any benefits from keeping a high balance on your cards. This is also an incredibly important factor in your score.

Average Age of Accounts: How long have your credit lines been open, on average? The longer your accounts are open, the more data available for a lender to have on your payment patterns, and so lenders feel more comfortable giving you credit. Nothing can improve this but time. This is usually of moderate importance.

Total Accounts: How many accounts do you have? This includes both credit cards and loans, and creditors usually like to see both loans and credit cards. This is usually of moderate importance.

Number of recent credit inquiries (“hard pulls”): Every time you apply for a credit card, the creditor will usually perform a “hard pull” to get your credit report. Each one impacts your score slightly in a downward direction, so don’t apply for new credit just before you need to take out a loan.

If you want to read more, here’s a solid post on the r/personalfinance wiki.

APPENDIX: MONITORING YOUR CREDIT

If you want to monitor your credit score, then I’d recommend finding something that does it for free - there’s no need for pay for anything. Many credit cards offer free credit score checks, and there are other services out there that’ll let you do it. Personally, I use Mint.

[1] I didn’t make this - it was stickied on the r/personalfinance sidebar years ago, but it’s basically my go-to when it comes to covering everything in one image.

[2] The exact process varies from card to card - from what I can tell, some cards will transfer over the entire history, while others will just enable you to build credit from the time you get the card forward. One of my friends has a card that says “Member Since ‘94” on it, despite the fact that he’s not 26 years old.