Bloomberg recently published a fantastic article from interviews with high-earners across the country (you can open up the link in incognito and you should be able to read it for free). It covers two important points for nerds like me who care about personal finance:

How your cost of living changes from city to city (within the US)

People with high incomes that don’t necessarily feel “rich”

Cost of living

It’s hard to compare salaries between e.g., downtown New York City or San Francisco to suburban Atlanta or Houston. Does a salary of $150K sound high to you? In Houston, it’s pretty good:

$150K in Houston entails earning more than double the median household income as an individual. Let’s look at Palo Alto. Bloomberg doesn’t account for tax differences between states, so we can use this calculator from SmartAsset to adjust for the state income taxes you’d pay:

In Palo Alto, your $149,999 gross salary has ~$10K in state taxes that someone in Houston isn’t paying - so let’s see where $139,755 gets you in Palo Alto:

At a national level, things don’t change (the bracket that Bloomberg uses goes from $100,000 to $149,999). At a local level, you’re right in the middle of household incomes (again, as an individual) and the percentage of your paycheck going to housing has more than doubled.

people that don’t feel rich

There’s a (very dry) book called The Millionaire Next Door, where the authors (Stanley and Danko) write ad-nauseam about two archetypes of people: UAWs (Under Accumulators of Wealth) and PAWs (Prodigious Accumulators of Wealth). The branding could probably be improved; the overall story is clear - some people (PAWs) save their money and feel financially strong, other people (UAWs) spend most of what they take in, have fully succumbed to lifestyle creep, and don’t feel rich. I’d take it a step further - people who spend every dollar they take in aren’t rich, regardless of their annual income. They’re on a spending treadmill; losing their job could easily mean ruin. They’re keeping up with the Joneses - fast cars, nice homes, using “summer” as a verb, etc. - but they haven’t cracked achieving mental freedom from financial worry. In fact, money worries them, because they know how precarious their situation is.

The survey from Bloomberg based on 1,000 responses from folks making at least $175,000 a year. Even in the highest cost-of-living areas, that’s above the median income (though I note that incomes are for larger metropolitan areas, and $175,000 in the urban core can be very different from $175,000 in the suburbs). The fascinating results from this study aren’t the folks that feel comfortable or rich. It’s the people who feel poor despite their high incomes that matter; pay attention to the black bars.

The black bars tend to not have $500,000 saved up - and they worry about money.

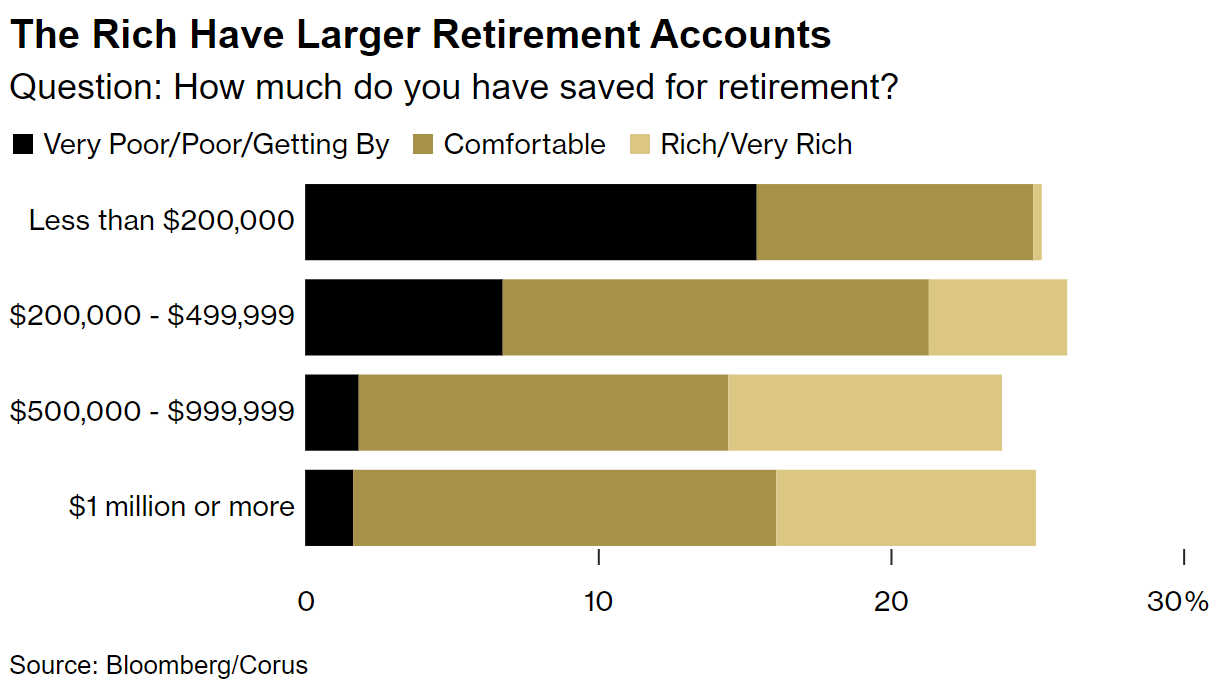

They also tend to not have saved up for retirement:

Money is an especially emotive topic; not seen in the graphs are incredibly important factors like age, health status, family status (kids change the equation quite a bit, I’d imagine), and spending level. You don’t see how history and culture shape individuals’ feelings about money; people will overindex to what they’ve experienced.

While reading through the article, I was noticing how people defined “feeling rich”. The primary theme was that it entailed not worrying about money — worries which could arise from future expenses, debt, or concerns about job stability; worries which could be mitigated from more cash in the bank.

I’ll leave you with a few reading materials that I found throughout my personal finance journey:

The Millionaire Next Door by Stanley and Danko